With the end of the 2023/24 tax year approaching, the time has come to prepare the final payroll. Submitting the last payroll of the year has a few extra steps. It’s important to know how to prepare for it.

When does the Final Payroll End?

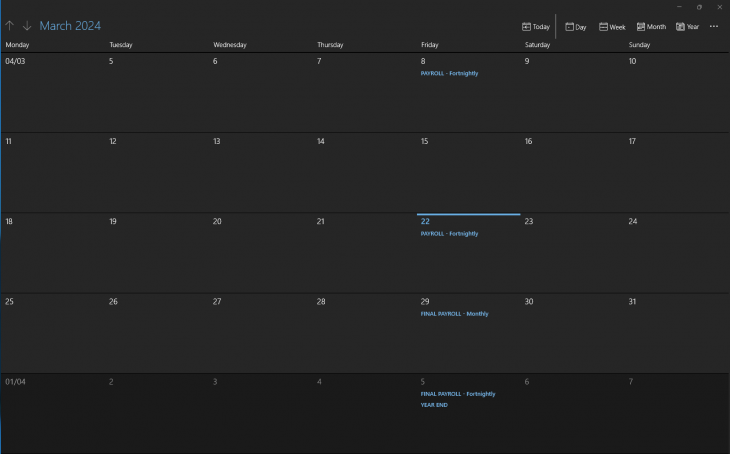

The final payroll will be the last payroll you submit before the tax year ends on 5th April 2024. If your workers are paid monthly their last payroll will always be Week 52 as they will always have 12 pay days. For weekly, fortnightly, and four-weekly payrolls, they could have a Week 53.

Week 53 payrolls are caused when there are 53 pay days during the year. If you pay your employees on Fridays, this year you may have a week 53 payroll if you last processed your payroll on the following dates:

- Any new employees are set up on your payroll software.

- Any employees that have left have been processed as leavers.

- Tax codes for 2024 are up to date.

What Should I Check Before Running the Final Payroll?

Correcting mistakes on the final payroll can be more difficult than other periods. Because of this, we would recommend double-checking all figures before processing them or sending them to your payroll provider. You should also check for the following:

- Any new employees are set up on your payroll software.

- Any employees that have left have been processed as leavers.

- Tax codes for 2024 are up to date.

How do I Submit the Final Payroll?

HMRC will be notified that a submission is for the final payroll through either a Full Payment Submission (FPS) or Employer Payment Summary (EPS). If you outsource your payroll, this will be done by your provider.

How do I Correct the Final Payroll?

If you need to change the figures included on the final payroll, the corrected FPS must be submitted by 19th April 2024.

If the wrong payment date is shown on the FPS, the corrected FPS must be submitted by 5th April 2024.

What are P60s?

A P60 is a form issued to all employees showing their earnings and tax deductions for the tax year. It is needed when completing the employment section of a Self-Assessment tax return. P60s must be sent before 31st May 2024.

What are P11Ds?

P11Ds are forms that must be submitted to HMRC to show the expenses and benefits provided to employees during the tax year. Examples of benefits include company cars, interest-free loans, and private medical insurance. The deadline for 2024 P11D submissions is 6th July 2024.

Changes from April 2024

Once the final payroll has been submitted, you should review the changes that may be needed during the new tax year. Increases to the National Living Wage were announced in November, whilst a decrease in National Insurance was confirmed during the Spring Budget.

You should also check if you have received any 2025 tax codes for your employees. These will be received either pay post or through your HMRC PAYE portal.

If you need any further information about the final payroll for 2024, or any other payroll services, please do not hesitate to contact us. We also provide a Payroll Year End Checklist which could be used as a guide.

Recent Comments