The way Self-Assessments are submitted is changing from April 2026. Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) will see a shift to digital record keeping for the self-employed and landlords.

What is MTD ITSA?

Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) is the next phase of the digitalization of the UK tax system. The change in the law will see self-employed individuals and landlords keeping records and submitting tax returns digitally.

The new rules will require the use of compliant software to submit a self-assessment, and quarterly submissions known as “Digital Quarterly Updates”.

Why is MTD ITSA Being Introduced?

MTD is being introduced to modernise the UK tax system. It was first announced in the 2015 Budget, with plans to update several aspects of the tax system in phases. This first change was MTD for VAT, which was implemented in 2019.

The change to digital self-assessments is expected to reduce the risk of human error, which accounts for much of the corrections needed for self-assessments each year. The reduction in errors is expected to reduce the self-assessment tax gap. This is an estimate of the tax that has not been collected by HMRC. It was 24.3% in the 2022-23 tax year. This is around £5.9bn that is estimated to have not been paid.

Using software is also expected to save time and be more productive for individuals as the information will be ready by the year end due to the quarterly updates, and records will be kept digitally, removing the need to sort through physical paperwork.

When Will MTD ITSA be Introduced?

MTD ITSA will be introduced in phases depending on an individual’s qualifying earnings. Using the table below, you can see when your self-employment or rental income will be subject to the New MTD ITSA rules:

| Yearly Qualifying Income | MTD Start Date |

| Over £50,000 | 6th April 2026 |

| Between £30,000 and £50,000 | 6th April 2027 |

| Below £30,000 | To Be Announced |

The government is currently reviewing whether MTD ITSA should apply to those with a turnover of less than £30,000. If the decision is made to implement MTD ITSA for this group, it should not start until after the other bands have submitted returns, but an exact date is not known.

MTD for partnerships had previously been scheduled for April 2025, however this has been postponed. A new start date has not yet been announced.

Digital Quarterly Updates

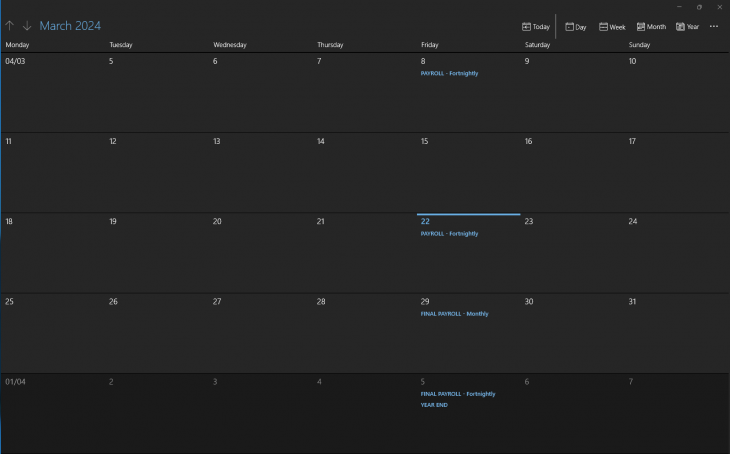

One of the largest changes that will be implemented with MTD ITSA is the introduction of Digital Quarterly Updates. Previously, self-assessments have required a single submission by 31st January. But under the new MTD ITSA rules, information must be submitted every quarter, as well as a final submission by 31st January.

Each update will include the income and expenditure for that quarter and must be submitted using MTD-compatible software. These submissions will be cumulative, meaning that you can make amendments to previous submissions within the next quarter, rather than submitting a separate return for corrections. This method is like a VAT return.

It is important to note that this change in submissions is not expected to affect payment methods, such as payments on account, as the final submission deadline will still be 31st January.

MTD-Compatible Software

MTD-ITSA requires the use of compatible software. For software to be classed as MTD compatible, it must meet the following requirements:

- It must allow digital record keeping. Examples include features for bank connections or transaction imports, and allow invoices, bills, and receipts to be posted. Records must be kept for at least 5 years as per government requirements.

- It must be able to submit the quarterly updates and final declaration directly to HMRC.

- It must generate the information for the final declaration and provide a calculation of the tax owed.

- It must be easy to use.

- It must update figures such as tax rates and allowances in line with government announcements.

- It must be secure and offer 2-factor authentication to help keep information safe.

A list of MTD-compatible software is available on the GOV.UK website.

Voluntary Sign-Up to MTD ITSA

If you would like to start submitting your self-assessment in line with MTD ITSA regulations before your earning band’s start date, you can sign up voluntarily if you meet the following criteria:

- Your details on HMRC are correct

- You live in the UK

- You have a National Insurance (NI) number

- You have submitted a Self-Assessment previously

- Your accounting period is from 6th April to 5th April

- You have no outstanding tax

Signing up will mean that you are abiding by MTD ITSA rules during the testing phase. Please note that, during the testing, you cannot claim any losses from previous years or change your accounting period. There is also criteria will prevent you from signing up, such as having a payment plan in place with HMRC.

Is Anyone Exempt from MTD ITSA?

Some individuals may be exempt from MTD ITSA, these include:

- Those who do not have a National Insurance (NI) number

- Anyone with a physical or mental condition which would prevent digital access

- Anyone who has difficulty using digital technology due to their age or a lack of accessibility in their area

If you would like further advice on how to prepare for MTD ITSA, or require any further help with your self-assessment, please do not hesitate to contact us.

Recent Comments