The deadline to notify HMRC that you must complete a self-assessment tax return is quickly approaching, but it can be tough to know if you need to complete one. HMRC have criteria for who needs to submit a return. This varies depending on the income that you receive.

What is a Self-Assessment?

A self-assessment reports income to HMRC which has not yet been taxed. Unlike employment income, where Income Tax and National Insurance are deducted from a person’s wages, the tax on other types of income is not deducted when it is received. This means that the tax must be collected through a self-assessment.

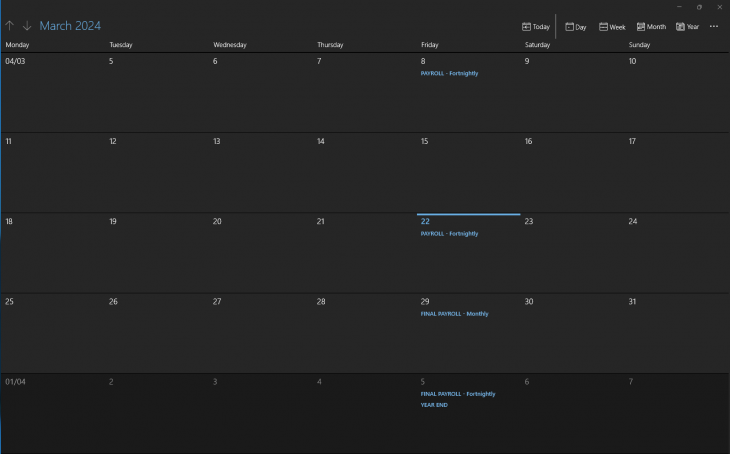

Self-assessments are currently submitted per tax year. Each tax year covers the period 6th April to 5th April. This means that the current tax year is 6th April 2023 to 5th April 2024. A shift towards quarterly returns will be introduced when Making Tax Digital (MTD) comes into effect.

Who Needs to Complete a Self-Assessment?

HMRC have set criteria which determine who should submit a self-assessment. As there are many ways to earn an income, eligibility is based on the type of income you have received during the tax year. You can find the information which applies to you by clicking the bullet points below:

Sole Traders and Self-Employed Individuals

If you are self-employed or a sole trader, you must submit a self-assessment tax return if you earn over £1,000 in the tax year.

Please note that you must notify HMRC that you have become self-employed within 3 months. Failure to do so will result in a £100 fine.

Income from Property Rental

If you receive income from a renting out a property that you own, you must complete a self-assessment. This will include your rental income and allowable expenses for the tax year.

Allowable expenses are costs relating to the property that you have paid. These include repair costs, water rates, cleaner’s fees, and rental costs if you are sub-letting. Please be aware that any costs paid by the occupants cannot be included on your return

If you are earning between £1,000 and £2,500 a year, contact HMRC. They will advise you whether a tax return is needed.

Dividend Income

If you are a company director or shareholder who receives dividends, you must complete a tax return.

Dividend tax thresholds follow the same bands as Income Tax, with the rate increasing as your taxable income increases. Dividend tax calculations can be affected by the personal and dividend allowances.

Business Partnership Income

If you are part of a business partnership, you must include the share of income you have received on a self-assessment. This is separate from your partnership tax return, but both must be submitted. On your self-assessment this income will be declared on an additional page called SA104.

High Taxable Income

You must complete a tax return if your adjusted taxable income is more than £150,000.

Adjusted net income is your total taxable income before any personal allowances have been applied, less certain tax reliefs (such as Gift-Aid donations and trading losses).

Capital Gains

If you have sold an item at a profit, which can be classed as an asset, you may have to pay capital gains tax. This must be included on your self-assessment.

You will have to pay capital gains tax on personal possessions worth £6,000 or more (excluding cars), business assets, and certain types of shares.

Sale of property will class as a capital gain if is not your main home, if you have let out your main home, or if you have used part of your home exclusively for business. Property gains must be reported to HMRC, and the tax must be paid, within 60 days of the sale. The figures submitted must still be included on your self-assessment, but you will not be taxed further if you have paid the capital gains tax.

High Income Child Benefit Charge

You will need to submit a self-assessment if either you or your partner receive Child Benefit, but one of your adjusted net incomes is more than £50,000. This is because you will receive a tax charge known as the High Income Child Benefit Charge. If you both have incomes greater than £50,000, whoever earns more will pay the charge.

The threshold for this charge will increase from the 2024/25 tax year.

Income Received from Abroad

If you are a UK resident and receive foreign income this must be included on a self-assessment.

If this income has already been taxed in another country, you may be eligible for Foreign Tax Credit. This is dependent on the double-taxation agreement that the UK has with the other country.

UK-Based Income for Non-UK Residents

If you are not a UK resident, you will still need to submit a self-assessment if:

- you receive rent from a UK property

- you sell goods or services/run a business in the UK

- you have a pension outside the UK but you were UK resident in one of the 5 previous tax years

- you have other untaxed UK income

Your tax will be calculated automatically on the days you work in the UK if you are employed in this country but live elsewhere.

I Am Eligible for Self-Assessment – How Do I Notify HMRC?

If you meet the criteria to submit a self-assessment, but have not received a notification, you must notify HMRC before 5th October by registering for self-assessment online.

If you have received a notification letter, or a self-assessment form, from HMRC you must complete and submit a tax return. You will receive this if HMRC are aware that you need to submit a return.

I Want Help to Complete My Self-Assessment – Who Can I Ask?

Accountants can register you for self-assessment and submit tax returns on your behalf. Once you have engaged with an accountant, they can request the relevant information from you and prepare your self-assessment for submission. If you are interested in our services, please do not hesitate to contact us.

If you need further information on how to pay your self-assessment tax please use our blog resources.

Recent Comments